At the heart of every blockchain network lies a crucial mechanism that makes decentralized finance possible: network consensus in crypto. Without consensus, blockchains would not be secure, transparent, or reliable—and global crypto trading as we know it would not exist.

From validating transactions to preventing fraud and double-spending, network consensus ensures that thousands of independent participants can agree on a single version of the truth without a central authority. For traders, this invisible process directly affects execution speed, data integrity, and confidence in the markets they trade.

In this article, we’ll break down what network consensus in crypto really means, how it works, why it matters for traders, and how this technological foundation supports professional trading models.

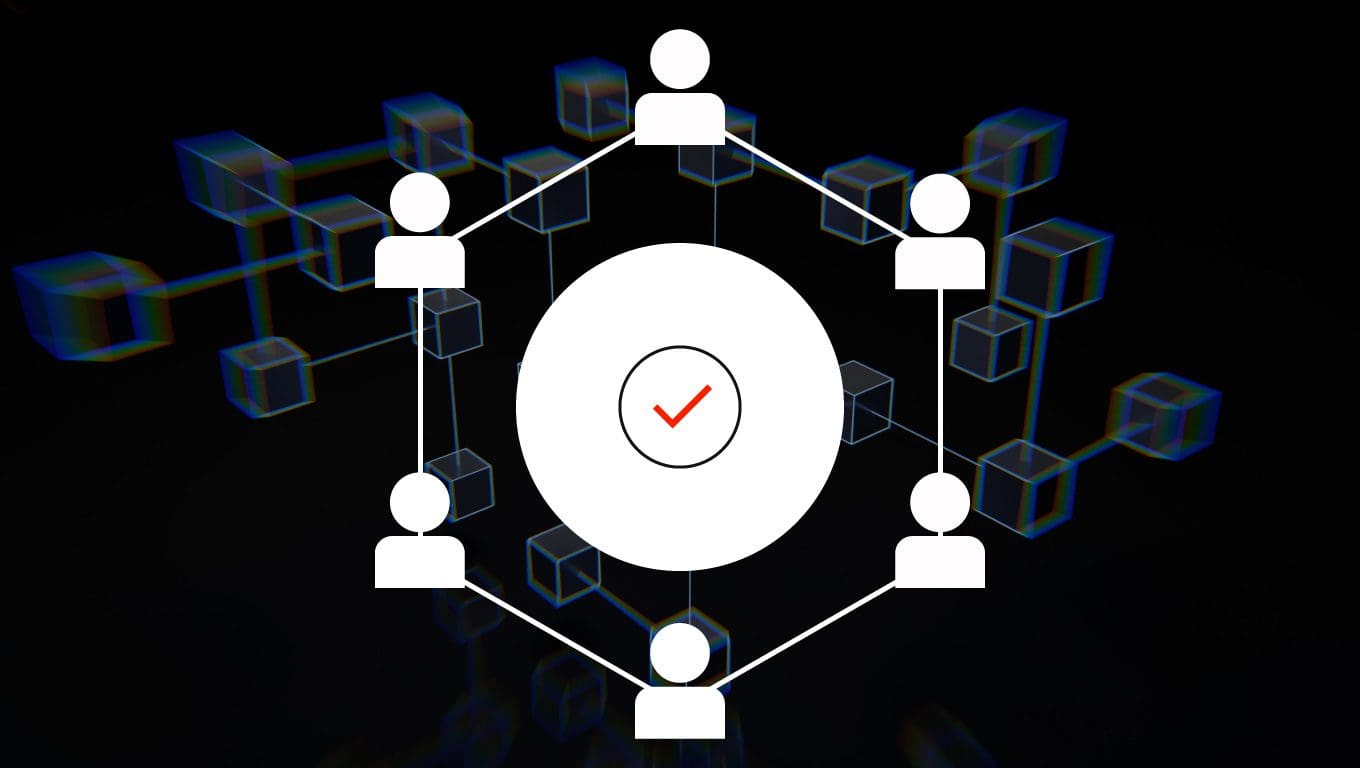

🔗 What Is Network Consensus in Crypto?

Network consensus in crypto refers to the process by which decentralized blockchain participants agree on:

- Which transactions are valid

- The correct order of transactions

- The current state of the blockchain ledger

Instead of relying on a central authority (like a bank or clearinghouse), blockchains use mathematical rules and economic incentives to maintain trust across a distributed network.

Consensus is what allows:

- Bitcoin to exist without a central bank

- Ethereum to run smart contracts securely

- Crypto markets to operate globally, 24/7

⚙️ How Network Consensus Works

Every blockchain network follows a predefined consensus algorithm. While the technical details vary, the core goal is always the same: achieve agreement without trust.

The process generally includes:

- Transaction broadcasting

- Validation by network participants

- Agreement on block inclusion

- Ledger updates across the network

Once consensus is reached, transactions become immutable—meaning they cannot be altered or reversed.

🧠 Common Types of Consensus Mechanisms

Proof of Work (PoW)

Used by Bitcoin, PoW relies on computational power to secure the network. Miners compete to solve cryptographic puzzles, ensuring security through energy and cost.

Strengths:

- High security

- Proven resilience

Trade-offs:

- Energy-intensive

- Slower transaction throughput

Proof of Stake (PoS)

Used by many modern blockchains, PoS selects validators based on the amount of crypto they stake.

Strengths:

- Energy-efficient

- Faster transactions

Trade-offs:

- Requires economic alignment

- Still evolving

Delegated and Hybrid Models

Some networks combine elements of PoW, PoS, or delegation to optimize speed, scalability, and decentralization.

🔍 Why Network Consensus Matters for Traders

While traders don’t interact directly with consensus algorithms, their impact is significant:

| Trading Factor | Role of Network Consensus |

|---|---|

| Transaction finality | Ensures trades settle securely |

| Market integrity | Prevents double-spending |

| Data reliability | Guarantees accurate price history |

| Network uptime | Enables continuous trading |

| Trust | Removes reliance on intermediaries |

In short, consensus is what makes crypto markets credible and tradable.

📊 Network Consensus and Market Transparency

Because consensus ensures that all participants share the same ledger:

- Trades are verifiable

- On-chain data is auditable

- Manipulation is harder to hide

- Market history cannot be rewritten

This transparency is critical for professional traders who rely on clean data and fair execution.

🤝 From Blockchain Consensus to Professional Trading

While network consensus secures the blockchain layer, traders still face challenges such as:

- Limited capital

- Emotional decision-making

- Inconsistent risk management

- Lack of structure

This is where crypto prop trading comes into play.

Prop trading firms provide capital and frameworks that allow traders to operate professionally on top of blockchain-based markets.

🟩 How Hash Hedge Builds on Crypto’s Foundation

Hash Hedge is a crypto proprietary trading firm designed to support traders with funding, structure, and clear rules.

While blockchain consensus ensures secure markets, Hash Hedge provides:

- Funded trading accounts

- Transparent evaluation challenges

- Defined drawdown and risk limits

- Profit sharing of up to 80%

- A professional trading environment for global traders

This combination allows traders to focus on strategy rather than stress.

🧭 How to Join Hash Hedge and Start Trading

If you want to trade crypto within a structured, transparent system, here’s how to get started:

1. Create an Account

Register on the Hash Hedge platform using your email address and complete verification.

2. Choose a Trading Challenge

Select a challenge based on your preferred account size. Each challenge includes:

- A profit target

- Maximum drawdown limits

- Clearly defined rules

3. Pass the Evaluation Phase

Trade in a simulated environment while respecting risk parameters. The focus is on consistency, not luck.

4. Complete Verification

A second phase confirms that your performance is repeatable and disciplined.

5. Receive a Funded Account

Once verified, you gain access to a funded crypto trading account. You trade firm capital and earn a share of profits.

🧠 Why Understanding Consensus Helps Traders

Even for non-technical traders, understanding network consensus in crypto provides valuable insight:

- It explains why crypto markets are trustless

- It reinforces confidence in transaction security

- It highlights why blockchain data is reliable

- It helps traders avoid misinformation and hype

Professional traders respect the infrastructure behind the assets they trade.

Network consensus in crypto is the foundation of decentralized trust. It ensures security, transparency, and reliability across blockchain networks—making global crypto trading possible.

When this technological foundation is combined with structured trading models like prop trading, traders gain the best of both worlds:

- Secure, transparent markets powered by consensus

- Professional frameworks that support consistent performance

Platforms like Hash Hedge build on blockchain’s strengths to help traders move from retail speculation to professional execution.